Bid Vs Ask Price When Selling Stock

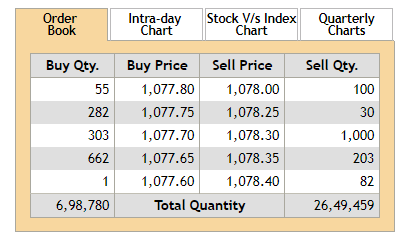

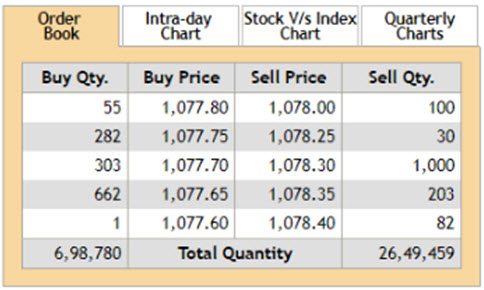

An individual investor looking at this spread would then know that if they want to sell 1 000.

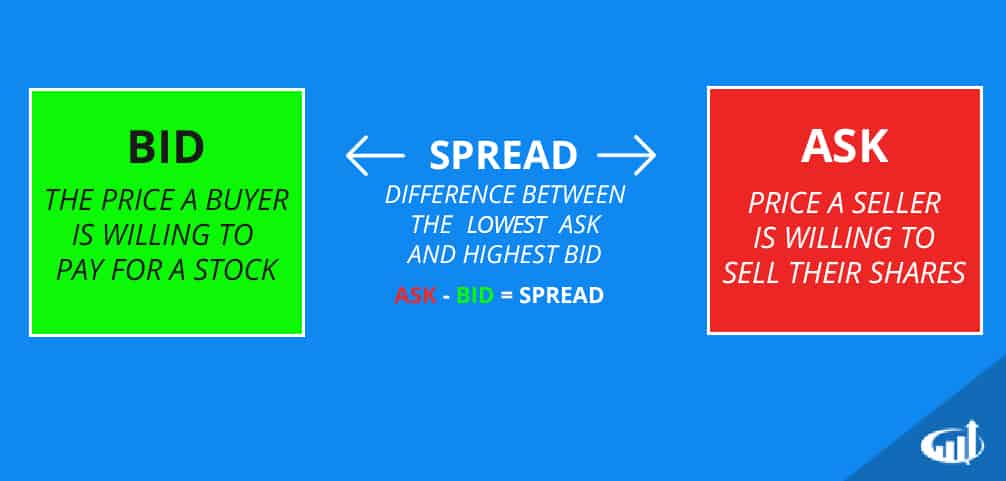

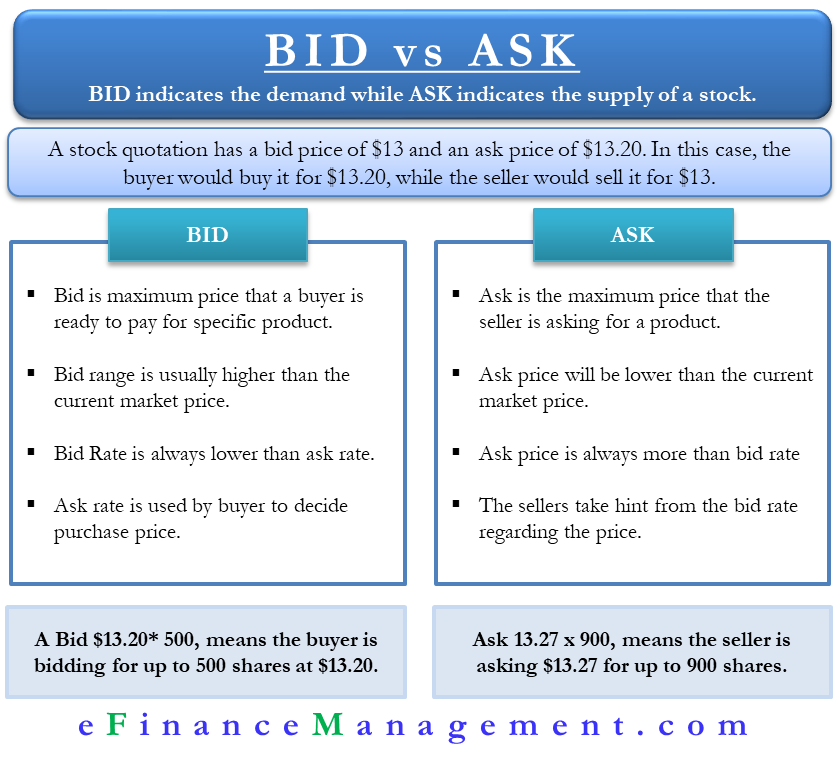

Bid vs ask price when selling stock. The bid price represents the maximum price that a buyer is willing to pay for a share of stock or other security. You would set a limit buy order with a target price of 575. The ask price represents the minimum price that a seller is willing to take for. You ll pay the ask price if you re buying the stock and you ll receive the bid price if you are selling the stock.

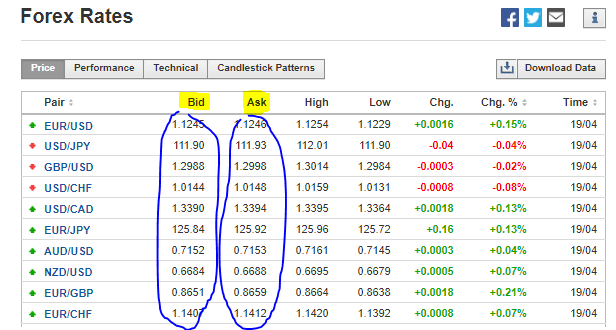

The difference between the bid and ask price is called the spread and it s kept as a profit by the broker or specialist who is handling the transaction. Highly liquid securities typically have narrow spreads while thinly traded. The bid price represents the highest price an investor is willing to pay for a share. The bid is 581 25 and the ask is 581 51.

The bid price is the highest amount of money a buyer is willing to pay for a particular product commodity. If you wanted to buy google you would look at the ask price. That leaves one other number which is in green the ask price. The spread is the difference between the asking price of 10 25 and the bid price of 10 or 25 cents.

The ask price represents the lowest price at which a shareholder is willing to part with shares. Now imagine you only have 575 in your account and you think google s price will go down. Investors are required by a market order to buy at the current ask price and sell at the current bid price. The bid is the price you are willing to buy the security.

The bid ask spread is the difference between the highest offered purchase price and the lowest offered sales price. Stock quotes display the bid and ask prices along with the bid and offer sizes for the shares in question. How are orders ever executed if prices are different.

/RobinhoodLevel2-9fc2600afd384175b8b6a9af7e37df62.png)