Hs Code Import Tax

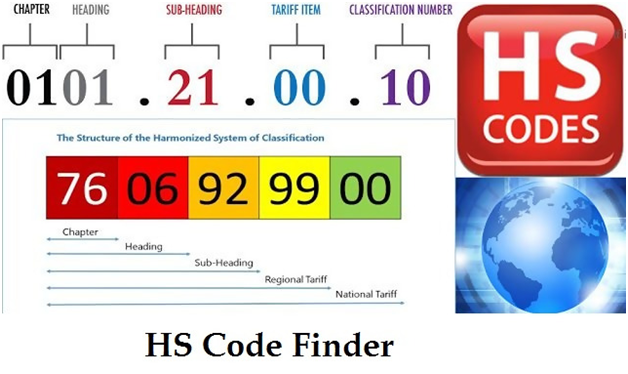

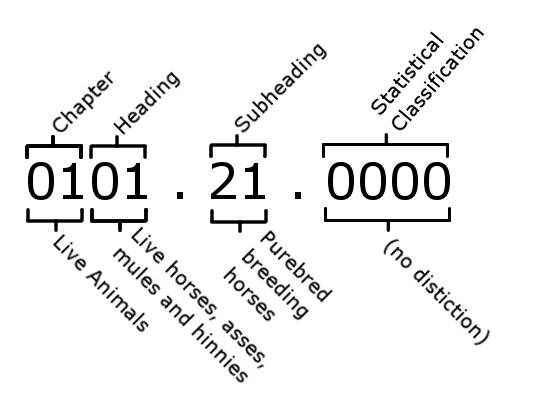

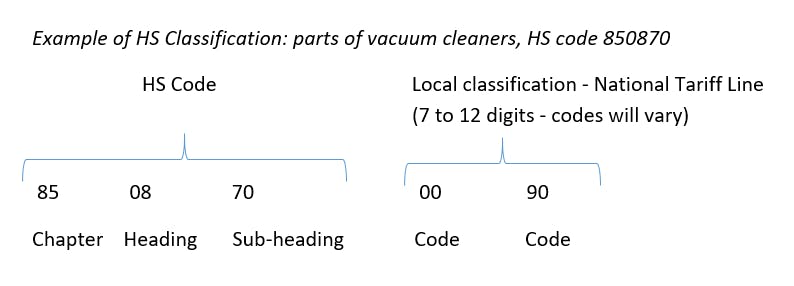

The hs is a nomenclature for the coding description and classification of goods products in international trade.

Hs code import tax. Usa customs import and export duty calculator. This site provides a chapter by chapter version of the hts. It will either return estimated to be exempt from duties or a customs duty rate cents kg. It s fast and free to try and covers over 100 destinations worldwide.

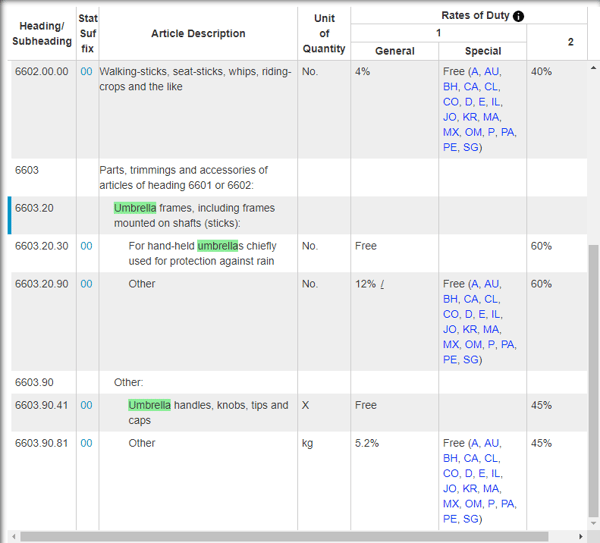

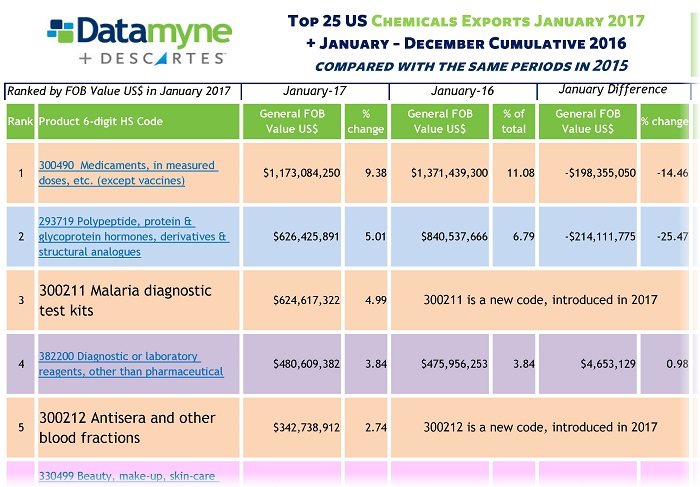

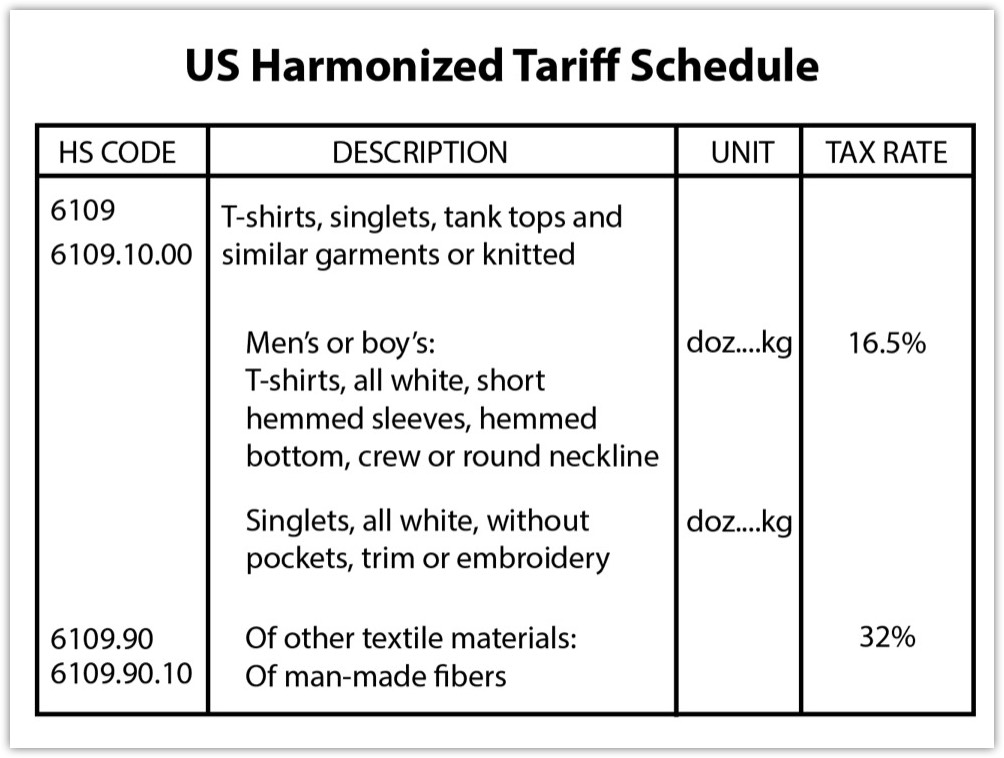

Calculate import duty and taxes in the web based calculator. Once you know your product s schedule b or hs number the first six digits of the 10 digit schedule b number you can determine the applicable tariff and tax rates for a specific foreign country. Each hts code has a corresponding duty rate that may be zero. Each hs code describes a particular trade product which allows governments around the world to charge the right tariffs.

Typically the rate is a percentage of the imported value a per piece rate or a per pound rate. The harmonized tariff system hts provides duty rates for virtually every item that exists. The import duty calculator will automatically calculate whether duty is payable for that hs code. For instance you might want to know the rate of duty of a wool suit.

By providing our team of brokers with several pieces of key information we can determine the rates due and assist you in clearing the products. Welcome to the harmonized tariff schedule reference tool. It consists of over 5 000 commodity groups. Controlled by the world customs organisation wco the system was first introduced in 1988.

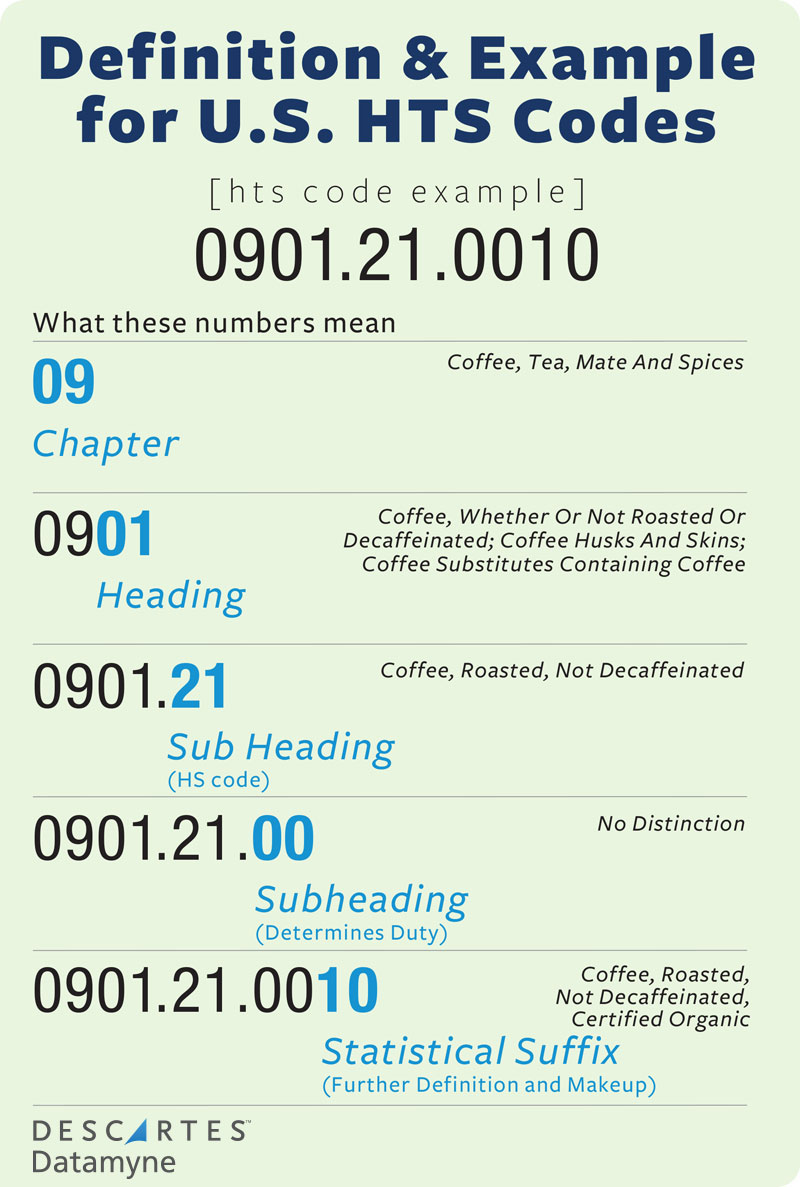

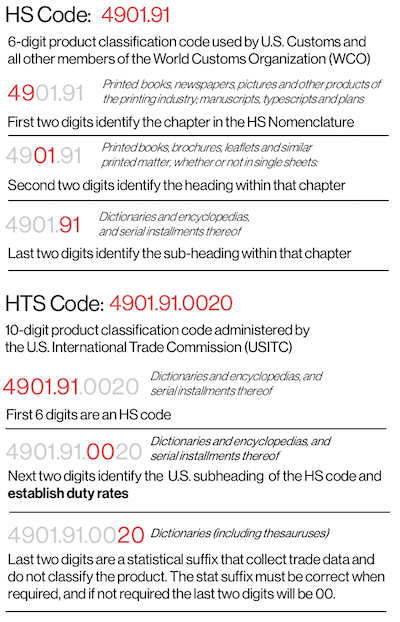

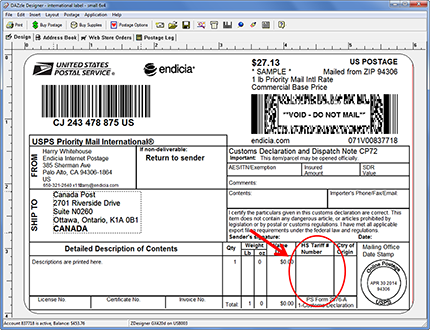

If it returns a customs duty rate the estimate duties button will become active. This document will then be used in the customs clearance process to reduce or eliminate import duty fees. Hts codes are ten digits and the first six numbers are the global or harmonized numbers. Harmonised system hs codes are an international standard for calculating import duty tax.

Goodada s usa customs import and export duty calculator will help you identify the export tariff rates you will pay for the usa. 9 10 digit are customs supervisory additional numbers and 11 13 are additional numbers for. The first step in determining duty rates also referred as tariffs is to identify the hs code or schedule b number for your product s. Input shipment weight and click on the button.

From august 1 2018 the china customs commodity hs code has been changed from the original 10 digit hs code to the new 13 digit hs code.