Hs Tariff Number Usps

There are 21 harmonized system sections the highest level of customs tariff code categorization.

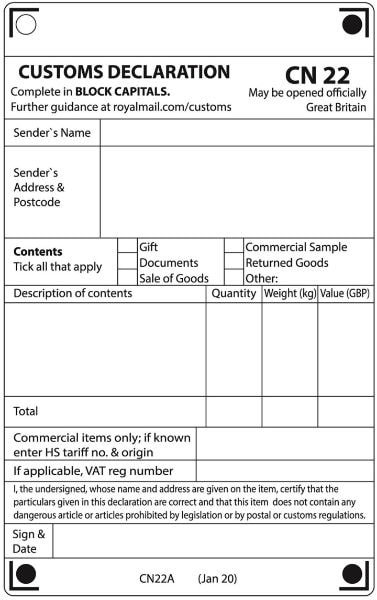

Hs tariff number usps. The form you need depends on the usps mail service you re using and the total value of what you re sending. Census bureau s web site or call 800 549 0595 option 3 then enter it below. Generate an internal transaction number itn or aes downtime citation from the u s. For items that require a universal postal union upu customs declaration form cn23.

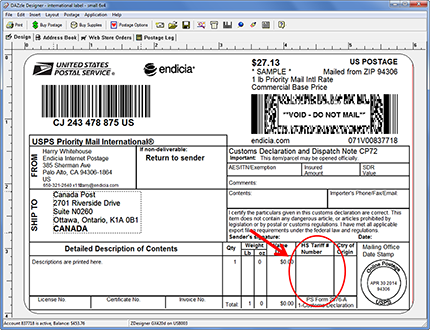

Compare international freight rates. Use click n ship to print both international postage and custom forms or use the usps customs forms tool to just print forms. Add item s cancel update update item. You usually need a customs form to ship overseas even with apo fpo and dpo mail.

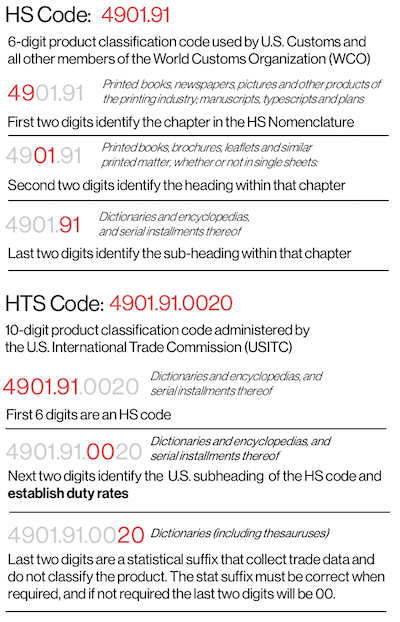

The type and identifier of each document accompanying the item invoice certificate license authorization for goods subject to quarantine. Total package weight. For instance in the us schedule b numbers and hts codes take their first 6 digits from the corresponding hs code. The hs assigns specific six digit codes for varying classifications and commodities.

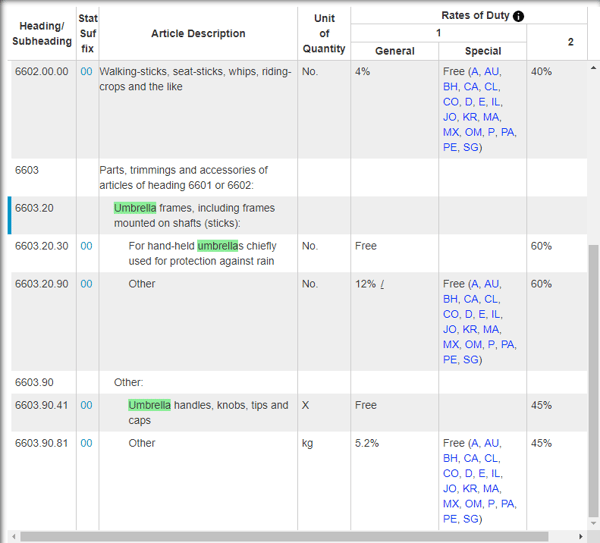

Each hs code describes a particular trade product which allows governments around the world to charge the right tariffs. Hs tariff number. There is a schedule b number for every physical product from paperclips to airplanes. This hs code list is used to unify broad categories like different types of.

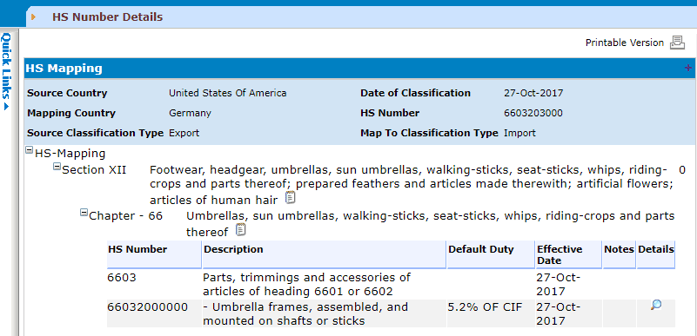

Hs code finder thematic search engine for finding correct tariff classification or to determine harmonized system code hs codes or hts code and cas number make visual search to learn the correct customs tariff classification for the goods you intend to import or export. The goal is to pick the most specific tariff code for your item. Customs forms filling out customs forms online. Please importantly note that eight digits hs codes presented within findhs codes search results are based on european union customs tariff nomenclature.

The importer s reference and details. Demystifying the hs tariff number field on your customs form to most new ecommerce business owners the harmonized tariff number field is the scary optional field see below that they avoid whenever they need to ship something out internationally with the u s. Perfumed bath salts would be 3307 30. These numbers are called harmonized tariff schedule hts codes.

The united states uses a 10 digit code to classify products for export known as a schedule b number with the first six digits being the hs number. Therefore when an 8 digits hs code is shown as a result of your search you need to take the first 6 digits of that hs code into consideration if the country of interest is not a part of. Then your hs tariff code is 2101. The hs tariff number the country of origin of the goods.

Countries are allowed to add longer codes to the first six digits for further classification.